How Ambit Finvest Nailed It With Personalized Ads Reports And Swift Reactions To Signals And Negative Data.

About the client:

Ambit Finvest Pvt. Ltd. is the systemically important Non-Banking Financial Company (NBFC) of the Ambit Group, which has so far helped 68,000+ MSME business owners. Spread across 11 states with 165+ branches, it offers customers business loans for expansion, working capital, Capital Expenditure, and caters to various other business loan requirements, thus being the pragati ke partner. Since inception, Ambit Finvest has disbursed over INR ~6,000 crore worth of loans and currently has an AUM of INR 3,800+ crore.

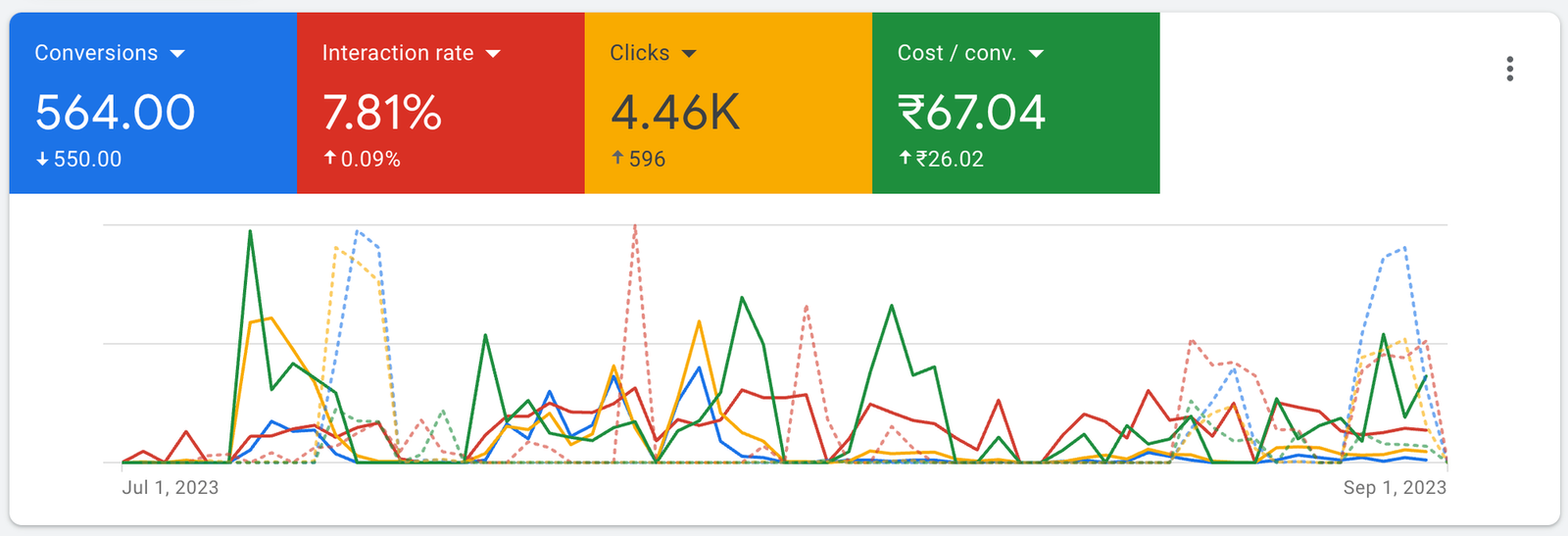

➥ Ambit’s Google Ads game,

went from↓

To this↓

➥ Ambit Finvest caters to small and medium-sized enterprises (SMEs) with a range of financial offerings like business loans, working capital financing, and structured products.

Being profitable and financially robust, Ambit Finvest recorded a net profit of Rs. 222 crore on a total income of Rs. 1,209 crore in the fiscal year ending March 31, 2023. Now, we had the opportunity to enhance their performance.

Mediachondria Digital stepped up to the plate, taking on the role of boosting performance marketing by delivering valuable leads.

➥ Challenges:

1 – Juggling three distinct properties with one agency led to executing multiple strategies simultaneously.

2 – Faced issues with an inadequate social media presence, credibility concerns, and a lack of a clear value proposition.

3- Being newcomers to Google Ads, they encountered challenges in winning the impression share.

➥ Resulting in:

1 – Experiencing high costs per conversion.

2 – Achieving a serviceable lead percentage significantly below industry standards.

3 – Missing out on potential educated leads (hot/warm leads).

➥ Possible solutions:

1 – Consider investing more funds, even with the high Customer Acquisition Cost (CAC).

2- Evaluate the option of discontinuing Google Ads and redirect focus towards other marketing channels with higher revenue potential.

3- Develop a strategic plan to effectively capture and secure serviceable leads.

💡Here’s what we did:

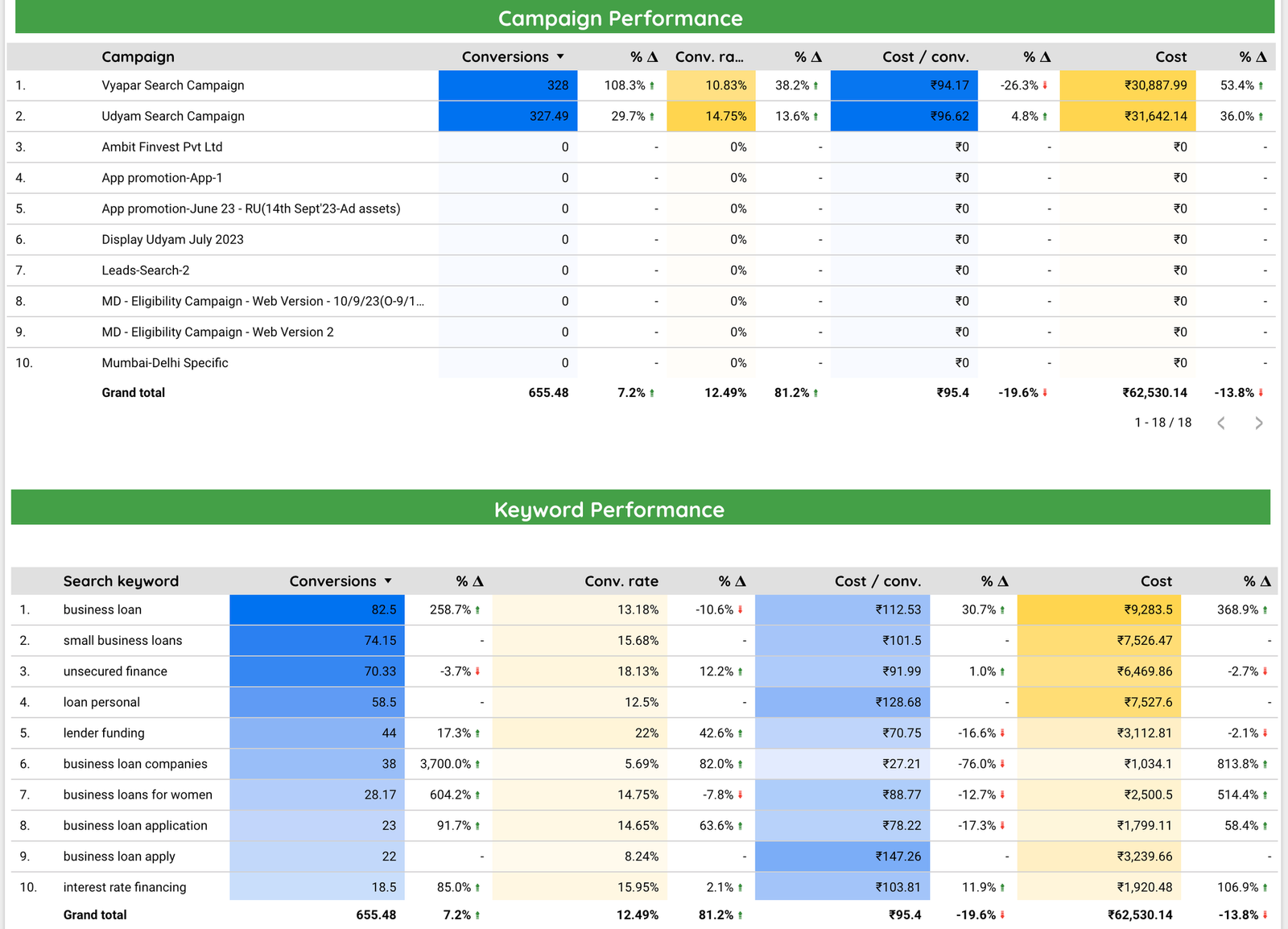

We crafted a personalized Looker Studio Analytics Metric Report to thoroughly analyze all the metrics at play!

💡 With these metrics in place, we gained rapid access to touchpoint data. Here’s what we uncovered.

We delved into keyword performance, constantly refining search terms daily and making adjustments to enhance results. Our focus was on specific search terms to optimize performance.

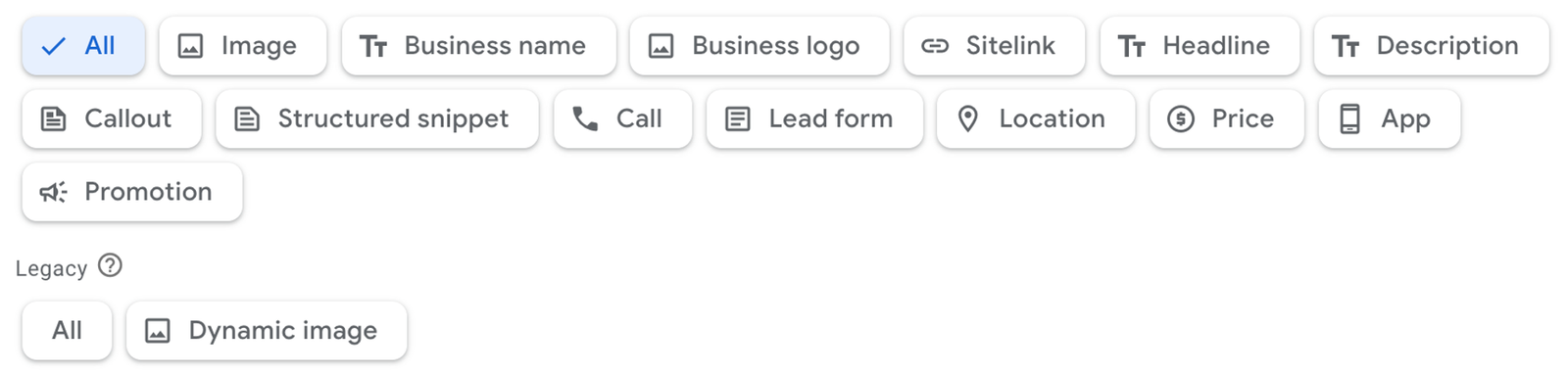

We took a deep dive into asset-wise clicks and conversions, recognizing the importance of securing more real estate on search ads to outshine competitors. To achieve this, we strategically generated additional assets, considering their impact. With the exception of call and promotion assets, we leveraged every asset to its maximum potential.

We consistently fine-tuned our strategies by optimizing signals aligned with audience behavior.

We adopted a dynamic approach by rotating assets every 15 days. Additionally, we replaced assets that did not contribute to the top combinations for conversion metrics in the past 28 days, ensuring a continuously effective strategy.

Understanding the conversion patterns by the hour allowed us to strategically schedule our ads. This enabled us to allocate our budgets wisely, focusing on the hours that yielded the best results for the business.

➥All these efforts culminated in significant improvements and positive outcomes, Resulting In:

💡 A remarkable 155.435% surge in conversions.

💡 A substantial 67.6808% reduction in the average cost per click.

💡 An impressive 5175.86% uptick in clicks, undoubtedly influenced by a strategic budget allocation.

💡 A notable 32.3606% decrease in the cost per conversion.